CBD Credit Card Processing: 2023 Edition

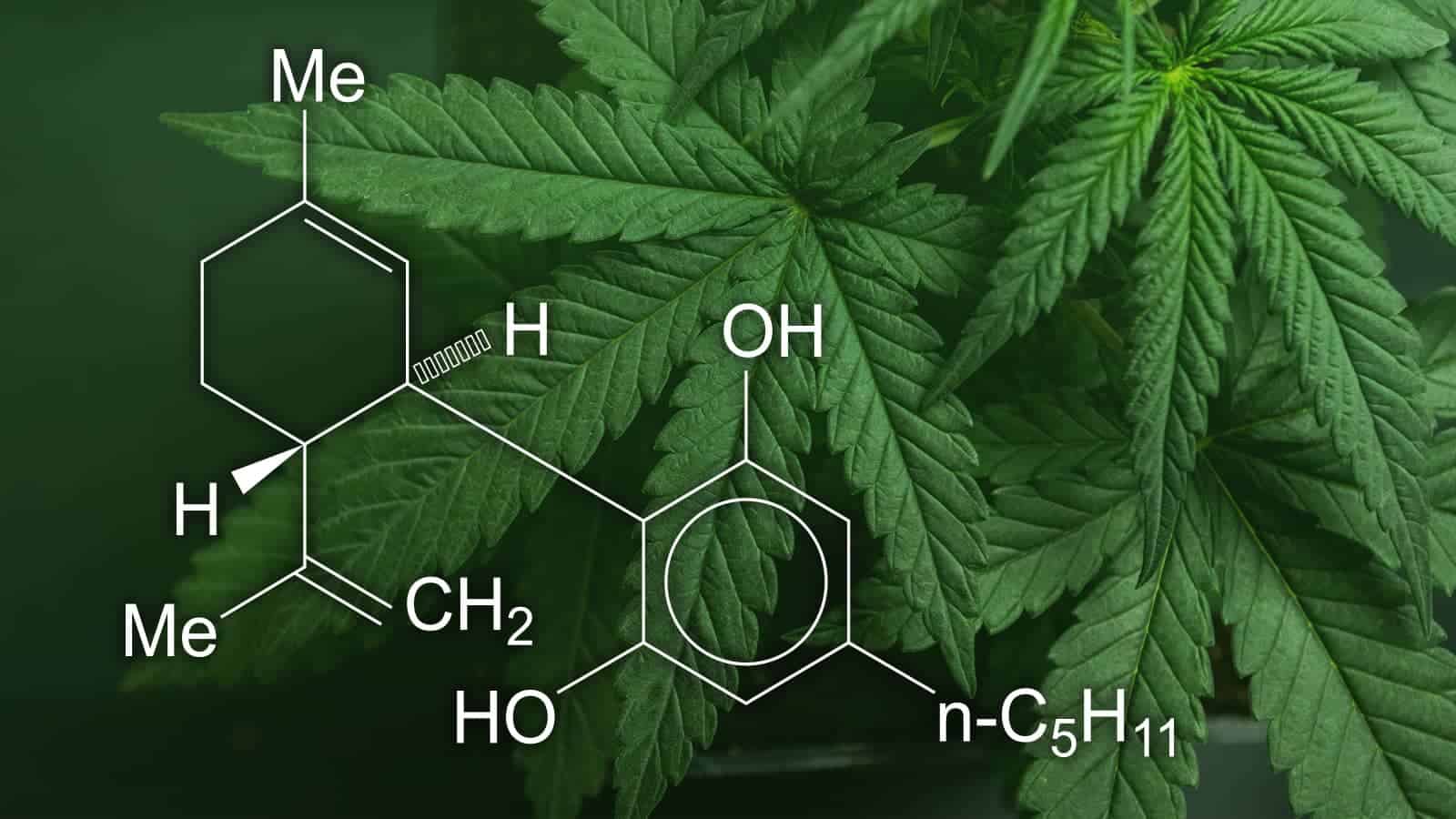

CBD has been a hot topic around the country and amongst lawmakers due to its health benefits, so it’s no surprise that more and more businesses are carrying CBD products to align with the growing consumer demand. CBD is the acronym for cannabidiol, a natural chemical compound within the cannabis plant. There are two primary types of cannabis plants — marijuana and hemp. Marijuana plants contain both CBD and THC, or tetrahydrocannabinol. THC is the psychoactive component of the marijuana plant that produces a “high” when ingested or inhaled. Hemp plants, however, do not contain much, if any, THC and are CBD-heavy.

CBD business is booming as consumers begin to experience the benefits of CBD with little-to-no side effects. However, because of its relation to marijuana (still a Schedule I illegal drug on a federal level despite its legalization in multiple states), CBD businesses are often considered high-risk by lenders, commercial property owners, and CBD credit card processing companies.

Table of Contents

- CBD Businesses on the Rise

- What It Means to Be Listed as a High-Risk Business

- What to Look for When Choosing a Payment Processor for CBD Businesses -Finding the Best Payment Processor for Your CBD Business

CBD Businesses on the Rise

The benefits of cannabis have been proven time and again for anxiety relief, cancer treatment, PTSD relief, chronic pain, eating disorders, and much more. Scientists discovered that CBD has as many benefits as marijuana for certain conditions, without the “high.” CBD has been legalized in many areas, and is available in tinctures, creams, pills, oils, candies, baked goods, and vape juice.

There’s no doubt that the CBD industry is on the fast track to success. CBD products are available almost everywhere now, from pricey salons and coffee shops to gas stations and convenience stores. According to Rolling Stone, the CBD industry is expected to hit $22 billion by 2022 and is showing no signs of slowing down. However, it’s important to understand the major restrictions tied to the legalization of hemp and cannabidiol products. Under the 2018 Farm Bill, more CBD products will become available, however, it does not mean that all CBD products will be considered legal moving forward.

This dubious legality makes B2B companies nervous to work with CBD businesses, who are considered high-risk as a result.

What It Means to Be Listed as a High-Risk Business

Apart from the difficulties of obtaining business funds, investors, and commercial space during the start-up phase, operating a high-risk business also affects day-to-day operations. Payment processing, and in particular credit and debit card processing, can be challenging for CBD business owners.

For example, business owners may:

- Have strict limitations on the number of transactions that can be processed per month

- Be charged higher pricing for credit card processing

- Be denied services completely

Unfortunately, many established credit card processors like PayPal and Stripe refuse to do business with high-risk companies, including CBD businesses. This can make it challenging to even operate the business on a daily basis.

Due to the nature of the business and the stringent legal restrictions on hemp and CBD products, all CBD businesses are considered to be high-risk. FDA regulations in the U.S. and other laws overseas also affect how other B2B companies interact with CBD businesses. CBD companies are a legal risk for lenders, banks, commercial property owners, and more until laws are once again revised in favor of responsible CBD sales and use.

What to Look for When Choosing a Payment Processor for CBD Businesses

It’s not easy for a CBD business to find a payment processor to work with. However, that doesn’t mean that you should work with the first processor that will do business with you. Here are some things to look for in a payment processor for your CBD company:

- A processor that will work with you as a partner

- Transparent pricing and billing practices

- A wide variety of payment processing and merchant services tools to meet your business needs

- Good customer service and support

- Short term contracts

- Specializes in high-risk payment processing

Finding the Best Payment Processor for Your CBD Business

Zenti is a friendly, flexible payment processor for every business. We’re dedicated to helping businesses make credit and debit card processing as easy and straightforward as possible. When other payment processors do everything they can to make things difficult for CBD businesses and other high-risk companies, Zenti offers simple solutions at an affordable cost without discrimination. Contact us today to learn more about our payment processing and other merchant services.

Read Next

Find out whether Authorize.Net works for high risk merchants, what restrictions you might face and how to get approved.

Get expert advice on selling CBD products on Shopify, including compliance tips and setting up secure payment options.

Find out why Square may deactivate merchant accounts and steps to resolve issues and maintain uninterrupted payment services.

Need a High-Risk Merchant Account?

Disruption-free payment processing at the best price for your situation, guaranteed.

Get Free Guidance Now!