CBD Oil Payment Processing

In 2018, CBD sales became legal. This product — which may be able to help people with various ailments — has become wildly popular in record time. It’s reached billions in sales and helped people address many physical problems. However, it remains shrouded in controversy. Many merchants aren’t familiar with CBD and get confused by the product, thinking it is marijuana and therefore illegal.

For business owners who sell CBD, this is not a minor problem: It results in them struggling to access traditional financial services, like being able to accept card payments. As a result, they can struggle to open a CBD merchant account allowing them to take payments.

Fortunately, CBD merchant processing services can still be accessed. At Zenti, we specialize in helping merchants with CBD payment processing. So if you operate a CBD merchant account, we can ensure you have access to the financial services you need.

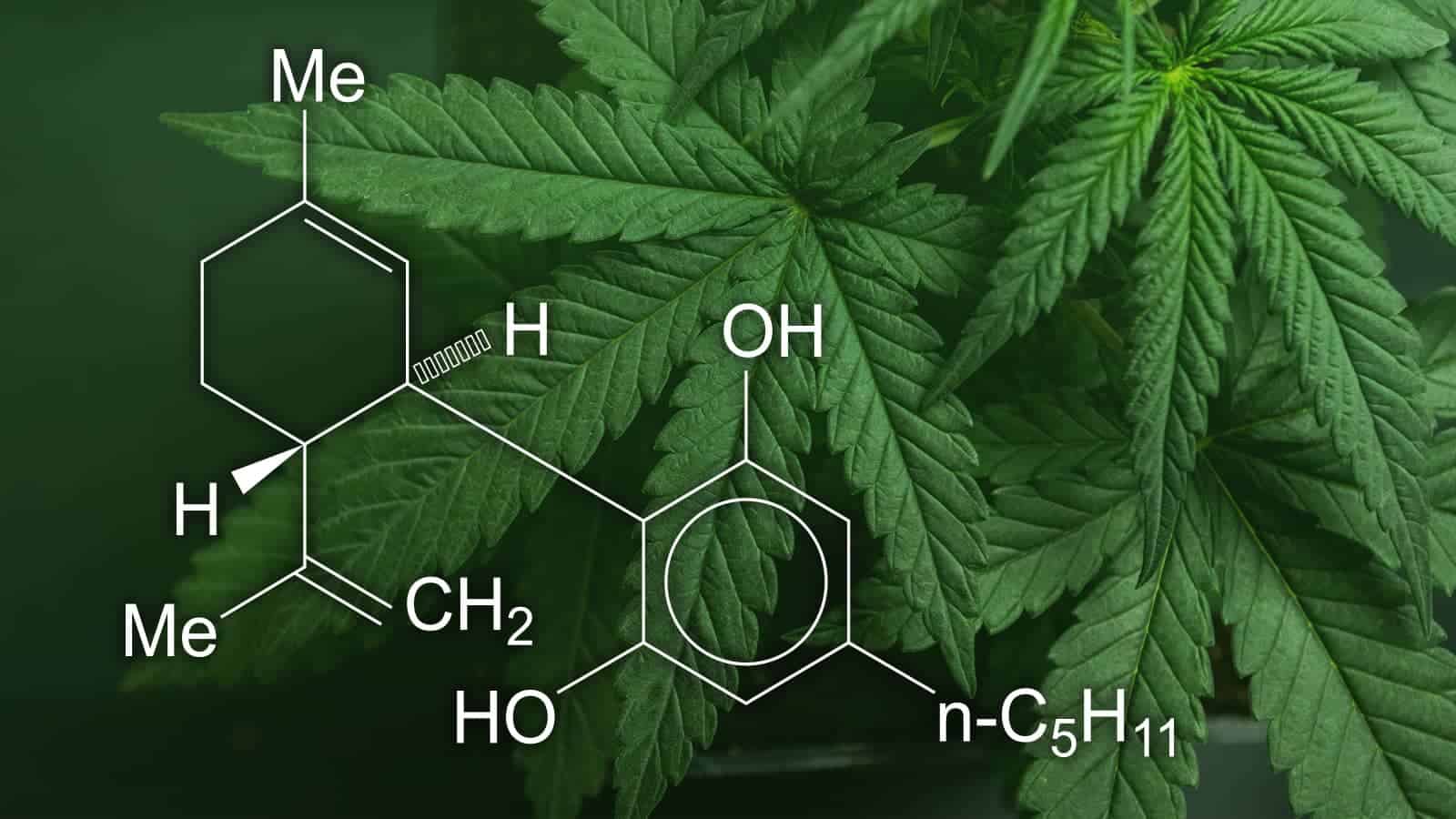

What Are CBD Products?

CBD is short for cannabidiol. It is a specific product made from the hemp plant. To be clear, it isn’t marijuana. It will not get anyone high, and to be legally solid within the United States, it must contain no more than .3% THC (tetrahydrocannabinol).

There are many different types of CBD, including full-spectrum (which contains THC) and broad-spectrum (which does not). It is sold in various forms, including edibles, lotions, creams, pills, and tinctures. People have different preferences in how they choose to consume CBD, which has led to a wide array of other uses.

CBD became legal thanks to the passage of the 2018 Farm Bill. This legalization removed CBD from the Schedule One list of restricted drugs maintained by the United States Food & Drug Administration (FDA). Of course, this didn’t end all of the controversy surrounding CBD, as extensive federal laws and regulations still require that the product be sold a certain way.

For example, CBD vendors cannot make any medical claims surrounding CBD. Furthermore, CBD vendors must adhere to relevant local and state laws. Different states have passed various laws of their own, adding to the confusion and creating a minefield of legal and regulatory challenges surrounding CBD.

What Does This Mean For My Business?

To be clear, this can be hugely problematic if you are involved in selling CBD Oil. Being tagged as a high-risk vendor means that many credit card processing services won’t work with you at all. The ones that work with you may charge very high prices, resulting in less profit.

If you are a high-risk business, the following is possible for you:

- You will pay more, and the amount you pay will increase for any company accepting payments for you. As such, you will pay higher flat fees, processing rates, monthly fees, and percentage fees on every transaction you process. Furthermore, these processing fees will add up and occur for every transaction you make, regardless of whether or not it is made in person (via a traditional point of sale device) or online. As such, you lose more money.

- High-risk businesses’ requirements are higher than those of their lower-risk counterparts. For example, you will have to have more cash in a rolling reserve to offset any fees. You will also likely have to fill out additional paperwork, provide a more extensive credit history, bank statements, processing history, and more. This is common for business types considered high-risk, regardless of the specific nature of the business.

- You likely would not have thought that more minor things would cost more. But, for example, there will be higher early termination fees, additional payments required for other services, and maybe even the need to pay for access to customer support services that would otherwise have come standard.

- All of this will take more time. If you need fast approval to start immediately, you may be out of luck. As such, you will need to start planning for the services you need earlier. You will have to budget more time to actually begin processing credit cards or debit cards.

What is a High-Risk Vendor?

Some merchant account providers and credit card processors categorize vendors by their relative risk in terms of chargebacks or fraud. This situation is also an issue for product segments more likely to face reputational challenges. Unfortunately, this is the case with CBD vendors.

A chargeback occurs when the purchaser of an item returns it or seeks a refund. Chargebacks can happen for many reasons. For example, a customer may be dissatisfied with the product. As a result, they may not have realized what they were buying. Alternatively, they may never have bought the product and may be a fraud victim. Fraud and data theft are more likely to occur in a high-risk industry, mainly if the data travels overseas, where privacy and security measures are less robust than in the United States.

Chargebacks are not cheap. They involve a loss of revenue and work for merchant account processors, and that’s why so many vendors — including PayPal, Stripe, Square, and credit cards — do what they can to limit chargebacks. Many merchant account processors are willing to do business with high-risk vendors. However, a high-risk merchant account will likely require various additional fees.

What Can I Do?

Fortunately, there are ways you can limit chargebacks, fraud, and other problems for your business, even if you’re a high-risk vendor. These include:

- First, work with your merchant account provider to identify what services they have that can reduce your chargeback ratio and ensure that your customers know what they purchase when they buy from your store.

- Be clear about the terms of service when a customer makes a purchase. This clarity eliminates confusion and helps to ensure that your customers are satisfied. In addition, you should be very clear about your refund policies, when your business will offer refunds, and when a customer is not eligible for a refund.

- Consider alternatives to refunds. If a customer wants a refund, ask if they would be willing to consider a gift card as an alternative.

- Make sure you have the highest level of security surrounding your data and how you accept credit cards. These security protections apply to both POS and online purchases. Doing so can help ensure that you only charge a credit card when the authorized user attempts to make a payment.

High-risk vendors deserve the same access to high-quality services as any other business. However, they also deserve specialized business solutions that can keep fees low and ensure that they are saving as much profit as humanely possible.

You deserve the best if you’re a high-risk business or involved in the CBD industry. At Zenti, we’ve worked with several high-risk businesses similar to CBD, including eCig companies and online pharmacies. This means that we understand the specific struggles that CBD business owners face, and we’re prepared to help you overcome them.

What Is the Controversy Around CBD Products?

Despite their legal status, the vending of CBD products causes many challenges. First, their connection to the cannabis industry makes many traditional merchant account processing services consider them dangerous or problematic. This perspective is outdated but prevalent nonetheless, as many vendors think that CBD and cannabis products are the same.

Furthermore, as noted above, extensive confusion still surrounds CBD. While the FDA has not yet issued federal regulations about how CBD should be labeled and tested, other states have done so, and the FDA has given warning letters to CBD vendors who are not marketing their product in line with federal law. Furthermore, despite its legal status, CBD stores are occasionally subjected to raids by local and state authorities who believe — often incorrectly — that vendors are selling illegal products.

These various factors often conspire to make CBD companies less likely to be able to do business. Indeed, these multiple issues help to explain why CBD is often treated as a high-risk business.

Unfortunately, this classification creates significant problems for CBD business owners, who often need specialized services that allow them to process credit card and ACH payments. Thankfully, these services are still available to business owners through various payment processors, including Zenti, which specializes in ensuring that CBD vendors can still process payments and engage in business with their customers.

What Other Services Might I Need?

Credit card payments barely scratch the surface of the financial products and services your business may need, even if you operate in a high-risk industry. Other financial assistance you need will include the following:

- eCommerce payment gateways: If you have any internet-based commerce component, you will need to work with a merchant account provider that can ensure access to online payment services and an eCommerce payment gateway. This means you can take credit or debit cards over the internet, securely process the data, and ensure you get the revenue from that transaction. For high-risk vendors, these services can get expensive. Unfortunately, eCommerce payment gateways are often portals to fraud due to the need to process a credit card without the card not being present. As such, you must find a vendor to ensure you aren’t fraudulently processing cards.

- Integrations with business operations: Many businesses need customized solutions. This means that you can get a merchant account provider who can not only process your credit cards but do so in a way that easily integrates with your accounting and inventory management system. Enhanced integration efforts ensure that your entire business easily flows around processing a credit card.

- eCheck processing: eChecks and ACH processing both remain very popular ways of processing payments, especially if recurring payments are involved. This isn’t necessary for all businesses, and your company must find a merchant account provider that only sells you services you genuinely need. However, these services can be hugely beneficial and may be worth considering.

- Retail options: Despite their high-risk nature, many businesses find that they need in-person retail opportunities that allow them to be able to make sales face-to-face. You will need secure devices or phone applications to run credit cards efficiently. Of course, a merchant account provider will have to supply you with the actual devices necessary to process the credit cards. They may have to teach you how these devices work and help to ensure you know how to use them and what to do if there is a problem. They may also need to work with you to ensure that you have multiple devices and that these devices can be repaired at a moment’s notice if you have any problems.

- Cryptocurrency: Cryptocurrency has become a wildly popular method used to process payments. There are thousands of types of cryptocurrencies today. As such, your business has to work with a vendor capable of processing many types of cryptos and ensuring that you get the money as fast as possible. The extreme volatility of the crypto sector means that speed is of the essence. Simply put, you can’t wait to get the crypto into your hands, or you risk it losing value. As such, you need to find a vendor who can quickly process transactions for you and ensure that it is done safely and securely.

At Zenti, we believe that being a high-risk merchant shouldn’t stop you from accessing all of the merchant services your business needs and being able to do so at an affordable price. We have years of experience in helping businesses get the CBD credit card processing they need, and we can help ensure you can manage your CBD payment processor business requirements.

Want more information? Contact us today, and learn more about how Zenti can help ensure your business can grow and thrive.

Read Next

Find out whether Authorize.Net works for high risk merchants, what restrictions you might face and how to get approved.

Get expert advice on selling CBD products on Shopify, including compliance tips and setting up secure payment options.

Find out why Square may deactivate merchant accounts and steps to resolve issues and maintain uninterrupted payment services.

Need a High-Risk Merchant Account?

Disruption-free payment processing at the best price for your situation, guaranteed.

Get Free Guidance Now!